As Warren Buffett famously said, “You only have to be able to evaluate companies within your circle of competence. The size of that circle is not very important; knowing its boundaries, however, is vital.” 1

One can also apply this concept to mutual insurance companies expanding beyond their state boundaries. Many mutuals are highly successful focusing on certain states, products, or geographies. They may look to capitalize on this success by expanding into new states, but this can be a perilous strategy if not executed properly. What makes a carrier successful in one market does not necessarily translate to others.

In thinking about how to capitalize on state expansion, it may be helpful to explore what has made your company successful in the first place. In your existing marketplace, consider what your constituents know about your company and what your company knows about the marketplace.

- Constituent Knowledge

- What do your insureds and agents know and like about your company? Why do they choose to do business with your company?

- What does your brand represent? How do you differentiate yourself?

- How well are mutual differentiators appreciated in the market?

- Company Knowledge

- What insureds do you target in your marketplace?

- How do you ensure that your key agents understand your company’s value proposition?

- How does your company stay abreast of the changing political environment and trends within your state? How does your company influence the political and legal environment?

- What means does your company employ to keep up with jurisdictional changes?

- How is your company’s experience mined to develop superior and pricing metrics?

Knowing what made you successful in your home state will help with any expansion. Keep in mind, however, that many of these home-state advantages disappear or become murkier with new state expansion.

In anticipation, the following list identifies some of the potential expansion pitfalls.

- Agent motivations are less understood. The trusted agent relationships you enjoy in your home state took years to build. By virtue of being a new entrant in a new state, your company may be viewed as the new kid on the block. Yes, the infamous “bottom drawer” does exist!

- Local nuances are missed or misunderstood. Expertise at a micro level is important.

- Critical testing of the market may be underappreciated. Companies may be lured into new states based on an agent’s growth and access promises. Are the promised outcomes really feasible? Does independent marketing research support the agent’s perspective? Further, what does your company bring to the market that isn’t being provided by the current participants?

- The marketplace may look the same, but is it? Apparent similarities may be deceptive, leading to confusing cultural similarities with jurisdictional differences.

- Pricing and underwriting decisions may have to be built on incongruous data from your home state.

- Are you prepared for higher expenses and loss ratios and the possibility of increased volatility?

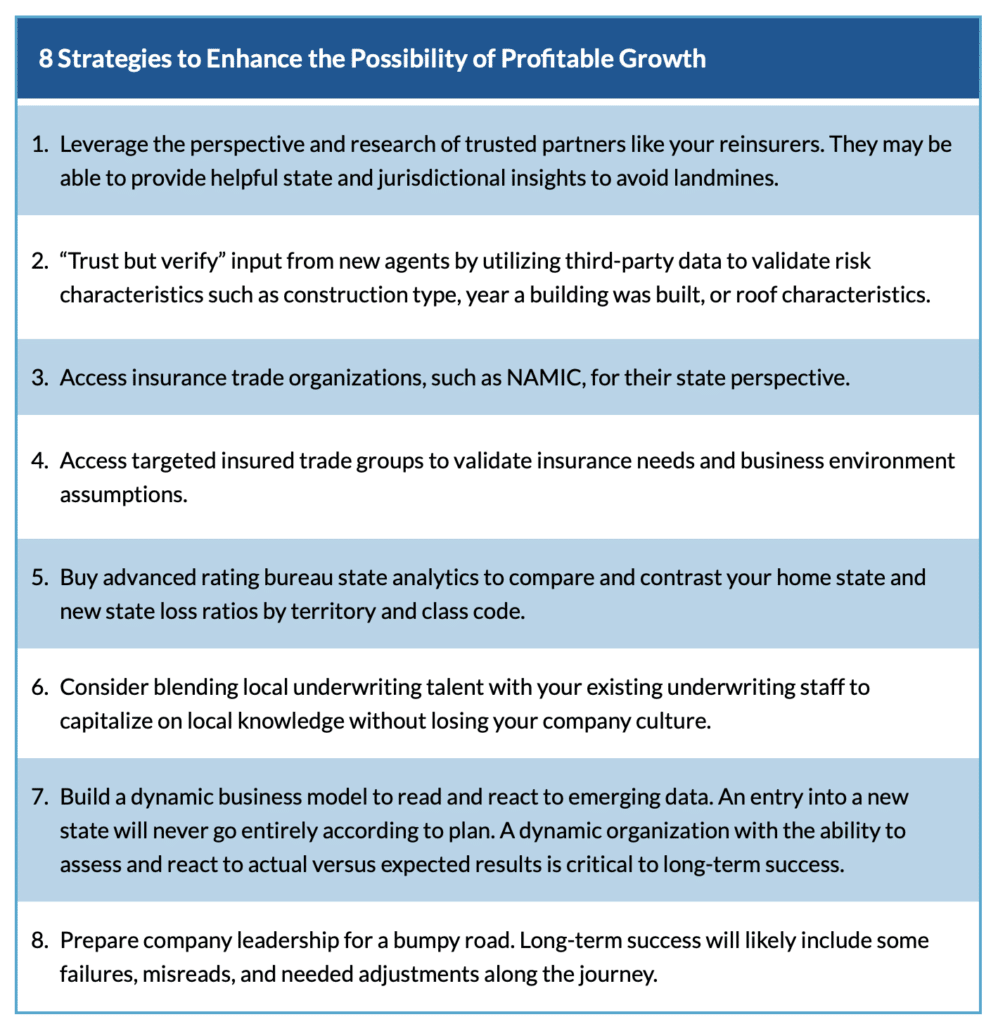

Fortunately, there are avenues for mutual carriers to greatly increase their success as they take advantage of state expansion opportunities. The following strategies may help smooth your expansion.

State expansion provides an excellent opportunity for profitable growth if done right. Harkening back to the essence of Warren’s quote, knowing the boundaries associated with the new state is critical to a company’s success. As always, please reach out, or check with your Gen Re account executive or check with MCA to discuss this topic in more detail.

Endnote

1 https://www.berkshirehathaway.com/letters/1996.html