Part 1 in our series examining the Small Commercial marketplace and the five strategies insurers can utilize for profitable expansion into this market.

The Small Commercial marketplace is an outstanding opportunity for insurance companies of all sizes to profitably grow, as long as company-specific strategies for success are in place.

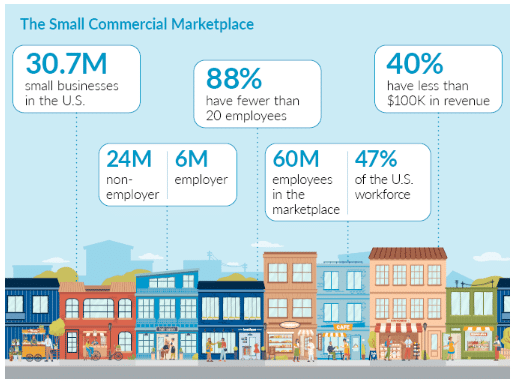

With a market size of more than $110 billion and growing, and no carrier controlling more than 5% of the market, the Small Commercial marketplace offers one of the most attractive market expansion opportunities for all carriers.

The Small Commercial marketplace is the convergence of the Personal Lines marketplace, which tends to be dominated by data and analytics, and the Middle market space where success is heavily dependent on underwriting expertise. The historically strong and profitable segment is also incredibly dynamic: its insureds are in transition (especially with the impact of COVID‑19), distribution is adjusting to meet changing customer expectations, and the utilization of data and technology are transforming how carriers operate.

Success in the Small Commercial marketplace requires strength across all components of the insurance value chain, including:

- Access to the targeted business through distribution

- Efficiencies to handle large volumes of business at low premiums

- Product that best matches price to risk

While large carriers are able to invest in all of the required capabilities to be successful, smaller carriers with more limited investment pools need to be more specific in targeted areas for growth. Across all carriers, the common capabilities required are:

- Distribution –A common phrase that carriers use is “meeting the small commercial customer wherever they want to purchase insurance.” Independent agents are still the predominant channel for the placement of Small Commercial business, but there are increasingly more choices for small business owners, such as payroll providers for Workers’ Comp or direct for Professional Liability. Carriers, especially those that are smaller or just entering the marketplace, need to make strategic decisions on distribution to be successful.

- Underwriting –Underwriting expertise can still be a differentiator for carriers, especially on the larger, more complex risks where the publicly available third-party data is not nearly as robust. One often unforeseen challenge for many carriers is a changing relationship between underwriters and agents as the smaller, less complex risks (and wins) are automated and the interaction centers more on the challenging risks.

- Product –Given the vastness of the marketplace, participation alone does not guarantee top- or bottom-line success. Carriers need to determine the specific markets where they can differentiate themselves and then ensure that they have the product strategy to go deep and win. Critical to success is determining the top priority for their target market and then creating solutions that meet that need.

- Digital Experience –The expectations of customers and agents for customer service delivery have increased significantly over the last few years, further accelerated by the pandemic. From seamless online transactions for simple tasks to omni-channel interactions for the more complex transactions, demand continues to rise. While an up‑front investment in digital technology is required to create these capabilities, successful carriers are able to not only drive efficiencies in long-term margins but provide an improved customer service experience. Those that don’t make the investment or are not able to get customers to adopt at a high rate will be left behind.

- Technology –One of the largest components of being successful in Small Commercial business is having excellent technology. The successful path for many insurtechs – from disruptors to high-value enablers – has focused on technology, which is no longer the barrier to entry it may have been years ago, especially for smaller insureds. Successful carriers balance an ease of doing business with underwriting integrity – straight-through processing for the most desirable risks and underwriting expertise for more complex risks.

Critical to all these capabilities is a strong foundation of data and analytics to consistently monitor performance and adjust tactics based on those results. Business performance based on distribution source can be vastly different even for the same product. While carriers may have a mid‑20s hit ratio on new business sourced from independent agents in their proprietary system, that same carrier may win only low single digits in the direct space – and have an entirely different risk profile. The ability to capture the data, analyze within the context of the marketplace, and then determine appropriate next steps is mission critical in a marketplace as dynamic as Small Commercial.

For straight-through processing, the ability to manage and analyze the data underlying the agent or direct quoting platform is critical to long-term success. The quality of pre-fill information, the accuracy of risk classification, and correlation of input to loss results are all areas that need to be addressed at the outset of this journey. Similar to improving a home, it is always easier (and more cost effective) to build from the foundation than to retro‑fit through expensive rework.

The Small Commercial marketplace is an outstanding opportunity for companies of every size to profitably grow, as long as company-specific strategies for success are in place. We look forward to a deeper discussion of each of the capabilities in this on‑going blog series. In the meantime, please reach out with any questions or to discuss this topic in more detail.

Next up: Aaron Augustyniak, Treaty Account Executive, and Jess Butler, Chief Operating Officer, Mutual Capital Analytics, will discuss distribution and the strategic decisions insurers, especially those that are smaller or just entering the marketplace, will need to be successful.