By Aaron Augustyniak, Treaty Account Executive, and Jess Butler, Chief Operating Officer, Mutual Capital Analytics

Part 2 in our series examining the Small Commercial marketplace and the five strategies insurers can utilize for profitable expansion into this market.

As carriers look for profitable growth opportunities, many are looking to expand their offerings in the Small Commercial marketplace. There are five capabilities that insurance companies need for success – and a strong distribution strategy is top of the list. Historically, many carriers have partnered with independent agents to write profitable, niched business. However, to successfully grow in the Small Commercial marketplace while maintaining strong margins, carriers will need to make strategic decisions regarding distribution expansion.

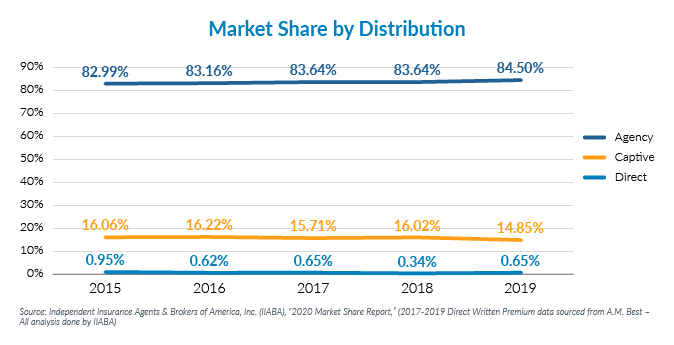

There are 3 main distribution models in Small Commercial:

- Captive Agent (14.9% of marketplace and trending downward)

- Independent Agent (84.5% and trending upward)

- with Proprietary Carrier Platforms

- with Comparative Rater Platform

- Direct to Consumer (0.65% of marketplace & flat in last 5 years)

Distribution Models

Most carriers begin their distribution channel with a captive or independent agency plant. Each of these business models requires an efficient way of quoting business, including a proprietary platform with a streamlined question set, third-party data for accuracy, prefill capabilities and data. Together, these factors will prove beneficial in performing analytics on pre-issuance policy set or quote data.

One of the most rapidly changing aspects of the agency distribution model in Commercial Lines is an acceleration in the use of comparative raters. Agents are continuously looking for ways to increase efficiency as speed to market continues to be a differentiating factor. With roughly 80% of the Personal Lines business coming through comparative raters today, agents want a similar solution for smaller Commercial risks.

Comparative Rater Platforms

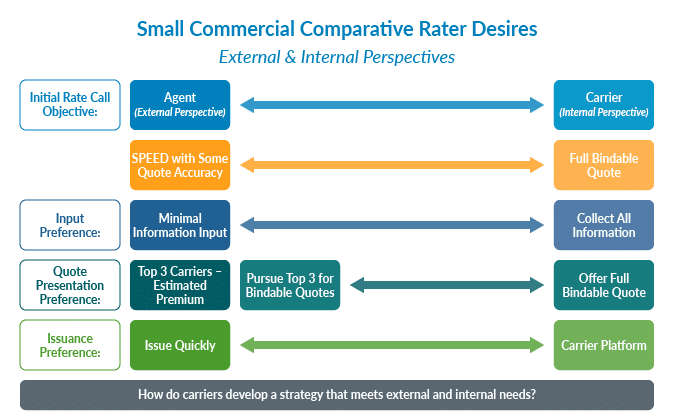

Carriers expanding to comparative rater platforms for Small Commercial should consider external and internal perspectives as they are developing their strategy:

Distribution Strategies

So how do carriers take the best of both worlds in developing their distribution strategy?

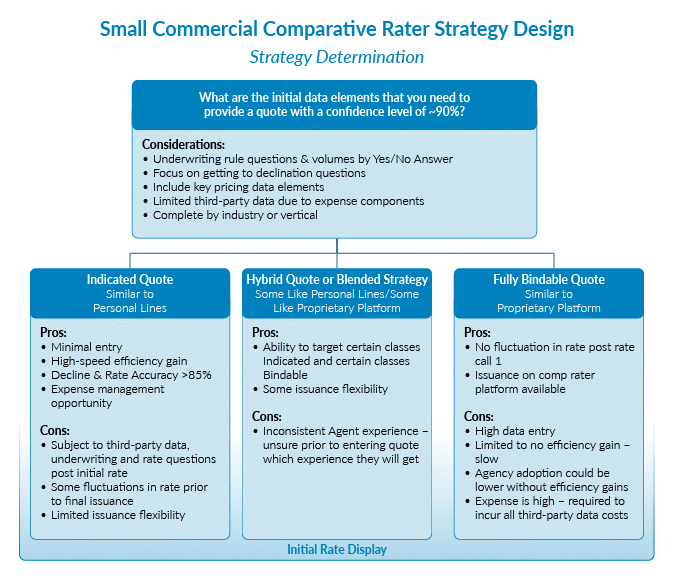

Focus on answering one primary question: What are the initial data elements that you need to provide a quote with a confidence level of ~90%?

After determining which strategy to pursue, ensuring you have the data and monitoring in place will be critical to achieving success in your distribution expansion initiative. There are differences in these two intake channels, notably, in the comparative rater channel quote volume will increase, but close ratio will drop significantly. Having the data from inception will be business critical to success.

Another distribution strategy that many carriers consider is going direct-to-consumer. The direct model is very different in that carriers work directly with their customers, who typically have less insurance knowledge than agents. Carriers that go this route will save on the expense of commission; however, this strategy requires up-front investments to establish capabilities in generating leads, driving web traffic and investing in call centers with licensed personnel to respond to customer needs. To be successful, this needs to be created at scale in order to cover the required investments.

As mutual carriers interested in expanding their writings in the Small Commercial marketplace consider their options, strategic decisions around distribution are mission critical. With so many distribution options, the ability for carriers to grow is well within reach. The challenge is continuing to grow the top line while maintaining the strong profitability that many carriers have created in their established Small Commercial portfolios.

As always, please reach out with any questions or if you’d like to have a deeper discussion on this topic.

Stay tuned for our next article in this series on the Small Commercial Marketplace. We will discuss the importance of underwriting expertise – and the changing relationship between underwriters and agents as the less complex risks are automated and interactions center around the more challenging risks.