Part 3 in our series examining the Small Commercial marketplace and the strategic capabilities insurers can utilize for profitable expansion in this market.

It is no secret that the world of insurance is moving increasingly towards efficient, online-based, low- or no-touch processing. Indeed, the Small Commercial space has been headed in this direction for some time. Agents and their clients demand ease of doing business, so prioritizing efficiencies is absolutely critical for companies to compete in Small Commercial. Most of the time, national carriers regard ease of doing business as interchangeable with straight through processing, but this is a huge mistake. Their oversight provides a rich opportunity for mutual companies to grow their Small Commercial portfolio.

The Small Commercial marketplace is roughly $110 billion and growing. Often generalized as one all-encompassing category, in reality the Small Commercial marketplace comprises a great diversity of risk types. For example, a business that sells homemade goods on Etsy and a plastic manufacturer might technically both be small, but their risk profiles are entirely different.

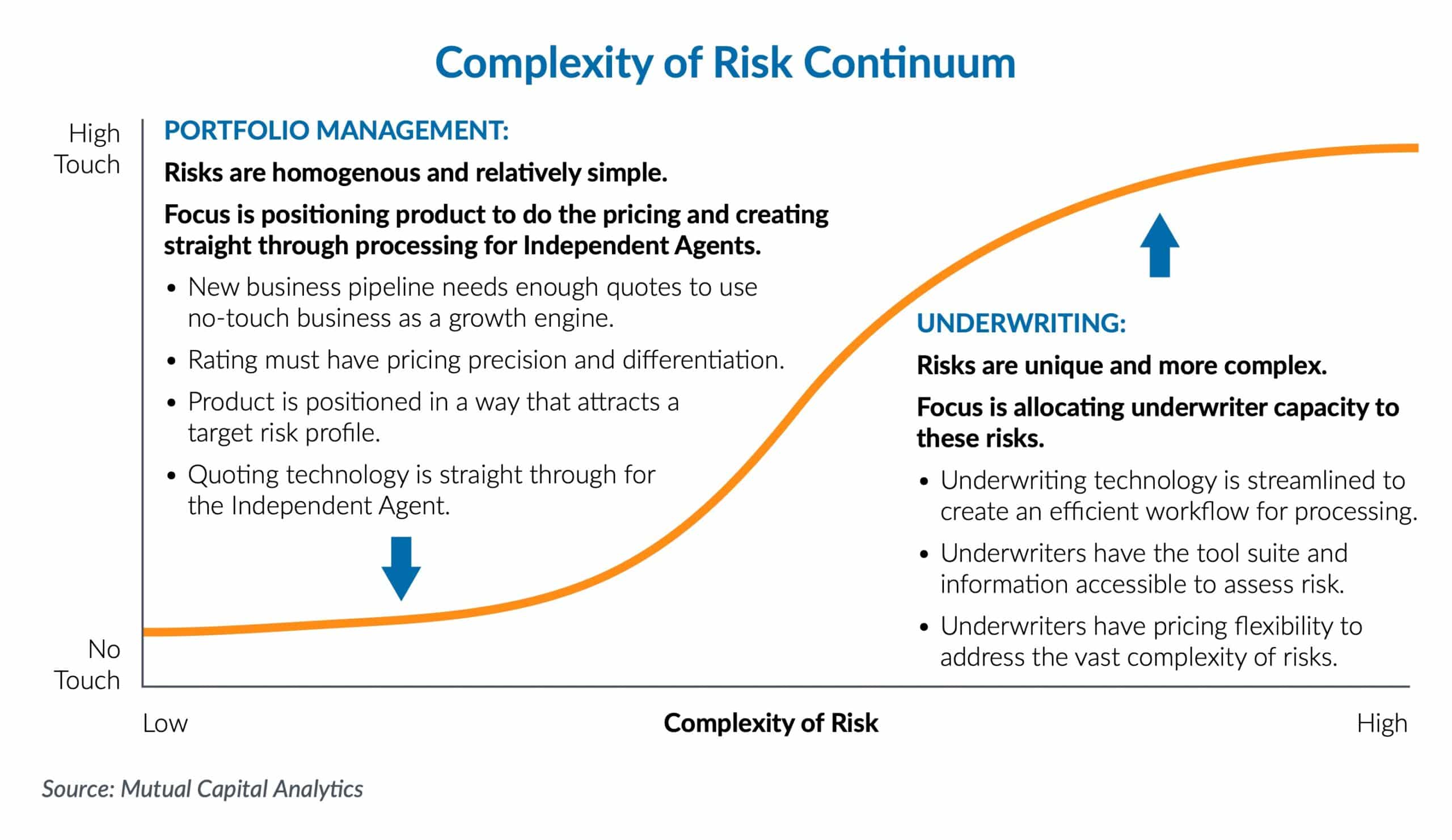

The diagram below illustrates the complexity of risk continuum. The information on the left side of the graphic represents how data, analytics, and technology rule the marketplace given the homogeneity of risks. This market operates more like the Personal Lines market. On the right side of the graphic are the more complex risks that require underwriting expertise to be more successful. They operate more like Middle Market risks, with a diversity of exposures and a lack of great third-party data.

There is no industry standard number for what is currently straight through processed by carriers. Commentary from carriers range from 25%-90% and all come with caveats – but let’s assume it is 50%. With 32 million small businesses in the U.S. and growing, that translates to more than 16 million Small Business accounts that are handled by underwriters. For these accounts, independent agents are still looking for ease of use, yet their needs and expectations are very different. They are looking for knowledgeable underwriters who have great technical capabilities, strong relationships to work closely with the agent, and can provide quick service levels. These are the hallmark of mutuals!

The transformation of the Small Commercial marketplace – with the introduction of data and analytics paired with technology – creates a huge opportunity for underwriters to provide even more value to their agents. No longer mired in processing the simple risks, underwriters can be the trusted partners for their agents as they both look to profitably grow.

Mutual companies that are successful in Small Commercial have made investments in their underwriters in the following areas:

1. Technical Capabilities – As the “machine” takes care of the simple risks, underwriters can become strategic advisors for their agents to help understand and appropriately cover the more complex risks. Successful underwriters in Small Commercial continue to expand their expertise to meet these needs – staying current on emerging trends like cyber, understanding the small commercial business owners evolving insurance needs as they grow and mature as a company, and building deep expertise on challenging underwriting issues (e.g., construction defect, social inflation). Rather than targeting markets with high potential market share where competition against national companies is likely to be fierce, mutuals will find success by focusing on niche target markets where their expertise gives them an edge.

2. Relationship Building – Although the easy wins of placing a $500 BOP will no longer be part of the day-to-day interaction between an agent and underwriter, underwriters can utilize their new-found capacity to truly partner with agents to help invest in their agents’ ability to win. This can take the form of investing in training for the agents’ newer staff, prospecting new accounts together, or building customized offerings for specific industries to target.

A key area where Mutuals are investing is improving the speed at which they can respond to opportunities that don’t “fit the box.” Agents don’t want to go into a queue to get a response – they want a technical expert to help them find solutions. Many of our Mutuals hear that a quick “no” is still better than a lengthy “yes.” Underwriters also have more time to focus on appetite clarification with the agent so less time is wasted on a guaranteed “no.” Additionally, with the smaller size of Mutuals, they are leveraging their ability to be nimble in responding to new opportunities, even at times engaging their CEO in getting a deal done.

3. Portfolio Management – While still spending time on individual risk decisions, underwriters are empowered with the data and analytics to manage their portfolio of business to optimize profit and growth. This can help them see the bigger picture as they build a portfolio of risks with their agents – diversification in size of risk, intentional industry mixes to balance changes in the macro economy, and mixes of lines of business to ensure sustainability of success. When frontline underwriters and senior management share the same goals, everyone is set up for success.

The Small Commercial marketplace continues to be an outstanding opportunity for Mutual carriers to profitability grow. Those that are most successful are investing in all aspects of their capabilities, notably technology, distribution, analytics, digital and underwriting. Carriers that can bring together these capabilities and provide their independent agents with an ease of doing business for all their Small Commercial clients are well positioned to capture more and more of this growing and diverse marketplace.